-

Recent Publications

Lazar, F. (2018), "Antitrust Immunity for Joint Ventures Among Alliance Airlines", Journal of Air Law and Commerce, 83(4), 787-838.

Abstract

immunity, the DOT risked preventing joint ventures that might have net positive effects for consumers—a type II error.2 On the other hand, when granting immunity, the DOT risked approving joint ventures that might have net negative effects—a type I error.3 Which error is more critical, and more likely? Antitrust immunity never made sense, even for so-called public policy purposes. Alliances did not spare major U.S. airlines from bankruptcy. There were frequent “open skies” agreements even without antitrust immunity. It is unlikely that the joint ventures’ efficiency benefits and antitrust immunity goal to encourage metal-neutrality have materialized. The regulators never thought about integration problems, competing goals, and different corporate cultures. Hence, it is unlikely that joint ventures’ efficiency benefits counteracted anticompetitive effects. In examining the potential anticompetitive impacts, the regulators did not fully appreciate the potential for restrictive trade practices—such as market foreclosure, switching costs, and access to hubs (e.g., slots, gates, check-in counters)—and the possibility of lessening competition in markets beyond countries or continents covered by the immunity. The European Commission (EC) and the DOT did note the potential for market foreclosure. Even though they acknowledged this possibility, market foreclosure did not influence their decisions because there was no evidence at the time of the proposed joint venture causing market foreclosure.4 Evidence became available years after the opportunity to observe joint ventures’ operations and competitive behavior. Time limits for antitrust immunity and periodic reviews are thus warranted. Therefore, governments should administer mandatory interlining, open access to frequent flyer programs, and time limits on antitrust immunity. While these recommendations do not guarantee flourishing competition in many international markets, they are critical for creating equal opportunity.

Lazar, F. and Prisman, E. (2017), "Valuing Historical Claims of Loss of Use of Land with Sparse Data", Valuation and Economic Loss Analysis, 13(1).

Abstract

There have been numerous historical claims by First Nations across Canada for damages resulting from the taking of land and the resulting loss of use of such land. Many of these cases have come before the courts. Generally in such cases, there is agreement that either the Federal Government and/or a provincial government has not fulfilled its fiduciary duty. Hence, the disputes before the courts usually pertain to valuing the losses of the First Nation(s) who is (are) the Plaintiff(s) in these cases. Since the original taking of the lands occurred many decades in the past, the court is challenged with difficult valuation issues, which are complicated by a lack of historical data and transaction records. Hence, even if the parties agree on the methodology for valuing the losses and on an annual lease rate, they still need to determine the annual price of the land. A common practice for generating a price trajectory for the land is to use a very small sample of land prices, and interpolate between these prices to estimate the intervening land prices. This practice does not generate the expected trajectory given the known observations. It implicitly assumes a deterministic price process with an annual fixed appreciation of the asset throughout the period. These assumptions are inconsistent both with realistic price movements and the literature modeling asset price processes. Consequently this practice can, and mostly does, generate a very significant bias in the value of the loss. This paper suggests a loss of use valuation method that is based on a land price process consistent with the literature modeling asset price processes.

Lazar, F. and Prisman, E. (2015), "Regulator’s Determination of Return on Equity in the Absence of Public Firms: The Case of Automobile Insurance in Ontario", Risk Management and Insurance Review, 18(2), 199–216.

Abstract

In a regulated market, such as automobile insurance (AI), regulators set the return on equity that insurers are allowed to achieve. Most insurers are engaged in a variety of insurance lines of business, and thus the full information beta methodology (FIB) is commonly employed to estimate the AI beta. The FIB uses two steps: first, the beta of each insurer is estimated, and then the beta of each line of business is estimated, as the beta of an insurer is a weighted average of the betas of the lines of business. When there are a sufficient number of public companies, company and market returns are used. Otherwise, researchers have resorted to using accounting data in the FIB. Theoretically, the two steps are not separable and the estimation should be done with one step. We introduce the one‐step methodology in our article. The one‐step and two‐step methodologies are compared empirically for the Ontario market of AI. Insurers in Ontario are predominantly private companies; thus, accounting data are used to estimate the AI beta. We show that a significant bias is introduced by the traditional, two‐step FIB methodology in estimating the betas for different lines of business, while insurers’ betas are very similar under both methods. This has a significant application to the estimation of betas of “pure players” in classic corporate finance. It implies that their betas and hence the resulting, required rates of return used in the net present value calculations should be estimated based on the one‐step method that we develop in this article.

Lazar, F. and Prisman, E. (2012), "Constructing Historical Yield Curves from Very Sparse Spot Rates: A Methodology and Examples from the 1920s Canadian Market", Journal of Business Valuation and Economic Loss Analysis, 7(1), 1-22.

Abstract

Legal disputes over compensation paid almost a century ago in lieu of a cash flow stream spanning a few decades present a number of challenges. These difficulties involve interrelated conceptual issues as well as technical obstacles. The re-evaluation of the compensation, in terms of dollars of the compensation time, requires knowledge of the yield curve at that time. However, the kept records of historical yield, is of only one rate: the long term spot rate. The rate was recorded and kept for the first business day of each month. Furthermore, the evaluation in today’s dollars requires present/future value calculations spanning over thirty years while yields for such a long duration are not observable. The paper offers a conceptual overview, proposes a methodology to overcome the technical difficulties, and exemplifies the implementation process.

Lazar, F. and Prisman, E. (2012), "Constructing Historical Yield Curves from Very Sparse Spot Rates: A Methodology and Examples from the 1920s Canadian Market", Journal of Business Valuation and Economic Loss Analysis, 7(1), 1-22.

Abstract

Legal disputes over compensation paid almost a century ago in lieu of a cash flow stream spanning a few decades present a number of challenges. These difficulties involve interrelated conceptual issues as well as technical obstacles. The re-evaluation of the compensation, in terms of dollars of the compensation time, requires knowledge of the yield curve at that time. However, the kept records of historical yield, is of only one rate: the long term spot rate. The rate was recorded and kept for the first business day of each month. Furthermore, the evaluation in today’s dollars requires present/future value calculations spanning over thirty years while yields for such a long duration are not observable. The paper offers a conceptual overview, proposes a methodology to overcome the technical difficulties, and exemplifies the implementation process.

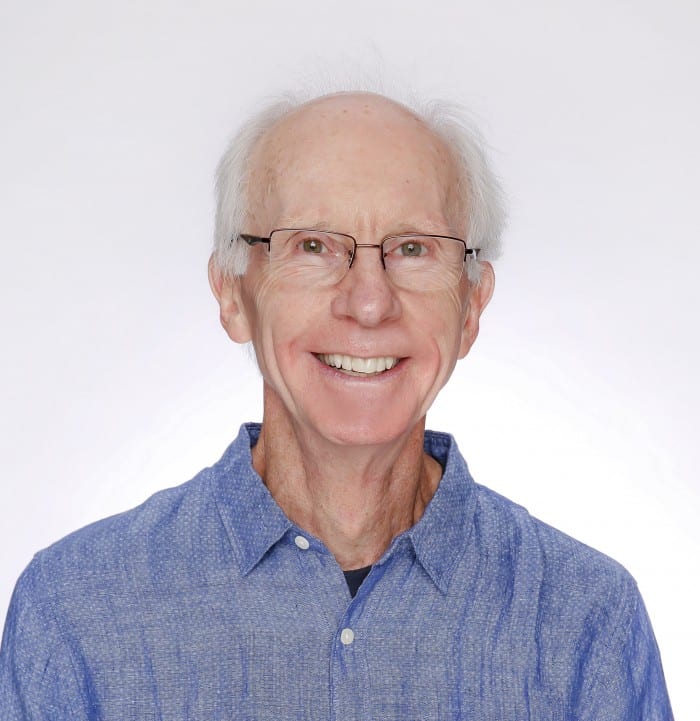

Fred Lazar

Associate Professor of Economics; Cross-appointed to Department of Economics; Faculty of Liberal Arts & Professional Studies